Table of Content

Visit the website of the Department of Insurance to evaluate the costs and rating of your chosen company. So, for instance, in case of a claim of $10,000, your insurer will pay you $9,000, deducting the $1000 deductible amount. With the correct calculation, you will have enough money to compensate for the damage.

For thecheapest home insurance, look for discount opportunities or bundle your home and auto insurance policies. When looking for the best home insurance companies in Arkansas, factors like customer service ratings, affordability, claims experience and financial stability are important. To find the best options for homeowners in Arkansas, MoneyGeek ranked insurance companies based on these factors and found that State Farm offers the best home insurance in the state. That said, the best option for you may be different depending on your specific needs.

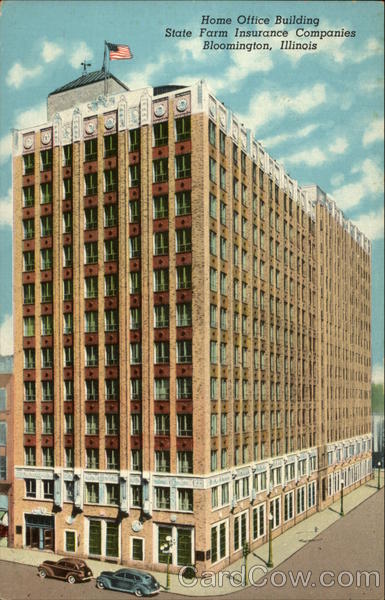

State Farm

You don’t have to sacrifice service quality to get cheaper rates. MoneyGeek rated the best affordable insurers for service quality, and Travelers was the winner with an average cost of $988 per year. The cost of homeowners insurance in Arkansas may change depending on your location in the state. At Opportunity Home Insurance Solutions, we put our customers above everything and offer them coverage policies that will help them build their home again. In addition, we don’t leave the side of our customers and provide many endorsements that can facilitate them in any way. Also check for customer feedbacks related to claim processes and any data related to the financial health of your selected insurer.

Floods from a high-risk area may even exceed the entire value of your home. You can get homeowners insurance coverage within minutes of getting your quotes and applying. If your belongings have a value that exceeds the minimum coverage, you might want to increase your homeowners insurance policy limit. However, such a change might increase the cost of your home insurance plan.

Best Homeowners Insurance In Arkansas To Cover Your Home (Rates From $178/month!)

Keep in mind that insurance rates and customer experience may vary depending on your circumstances. MoneyGeek broke down unique coverages and discounts to show how State Farm and Nationwide got the highest ratings in Arkansas. Some carriers may be represented by affiliates or subsidiaries.

MoneyGeek also rated the best home insurance companies in Arkansas for people with expensive homes. Using insurance quotes for $2 million homes and customer satisfaction ratings, MoneyGeek found the top options for high-value homes in the state. Policygenius analyzed thousands of quotes from the 5 largest Arkansas insurers to find the average cost of homeowners insurance with each company in 2022. Power customer satisfaction scores and compared that with the coverage needs of Arkansas residents to find the best homeowners insurance in Arkansas.

Best Homeowners Insurance Companies in Arkansas of 2023

You can also get protection against expenses incurred due to identity theft. The company also has discount programs like the home buyer discount, which is given to individuals with homes bought within the last 12 months. The company ranks first in Arkansas for homeowners who are more concerned about service quality than cost. It offers rare coverages like the specialty vehicle, which protects your boats, ATVs and off-road vehicles when added.

MoneyGeek’s research shows that individuals with good credit scores pay an average of $3,642 per year, while those with low credit scores pay $7,262 annually. On average, it costs $2,004 per year to insure a home built in 2015. By contrast, a homeowners insurance policy for a house constructed in 2000 costs an average of $2,819 per year. Based on the sample quotes we received on homes in various cities throughout the state, we found that average monthly home insurance premiums typically fall between $100 and $160 per month. Additionally, you can get extra protection separately through your local agent for items like home rental insurance or home business liability insurance. (DBA Simply Insurance™ in Georgia) "Simply Insurance™" is a licensed independent insurance broker anddoesn't underwrite any insurance policy described on this website.

State Farm Homeowners Insurance Pros & Cons

Now let’s explore some types of insurance policies available for homeowners. So, if you go for less costly insurance, you will only get a small coverage. But in case of expensive insurance, you will benefit from an expansive coverage. Now this feature is what makes home insurance quite attractive. While moving out of your house during repairs is quite rare, however, if it happens, you will thank us for convincing you to get a home insurance policy from Opportunity Home Insurance Solutions.

Prudential Financial was founded on the belief that financial security should be within reach for everyone, and for over 140 years, it has helped its customers reach their potential and... During the late 1800s, a group of businessmen faced an overwhelming problem unique to their industry. They needed to protect their glass greenhouses from the ravages of hail.

Now every insurance company will claim that their service is matchable. However, you should believe the words of current policyholders and check their retention rate. An actual cash value coverage pays the net amount of cost incurred to repair your property after deducting depreciation. This coverage is not very common for houses but does apply to personal belongings. Unfortunately, home insurance policies do not cover for the destruction related to earthquakes, floods or poor maintenance.

With an average rate of $2,293 per year, Farmers has the cheapest home insurance rates for Arkansas homes that have a swimming pool, while State Farm’s average yearly premium of $2,890 is the most expensive. Insurance companies look at your credit score as a way to determine if you are a high risk to insure. Customers with poor credit are more likely to file insurance claims for small damages or losses, so insurers will often charge higher rates to customers with bad credit. Since not every home insurance policy is right for every homeowner, Farmers offers three flexible levels of coverage to choose from.

Applying for homeowners insurance in Arkansas is easy and can take just a few minutes. Your lender will want you to have homeowners insurance lined up and ready to go before you come to the closing. It’s important to know what your policy won’t cover before you purchase. Call an agent or the company if there are any unclear questions. Then, you’ll need to gather all of the necessary documentation, including photos of the damage and a list of repairs that need to be made. Once the insurance adjuster has approved your claim, you can begin making repairs.

Despite not having the cheapest average rate, State Farm’s unique coverage offerings and high-quality service helped it rank first in Arkansas. For instance, you can get property and liability coverage when you rent out your home temporarily for more than 30 nights in a year. This coverage is not often offered by other insurance companies.

These are sample rates and should be used for comparative purposes only. Bankrate follows a stricteditorial policy, so you can trust that we’re putting your interests first. All of our content is authored byhighly qualified professionalsand edited bysubject matter experts, who ensure everything we publish is objective, accurate and trustworthy. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Shelter’s average annual cost for Arkansas homeowners insurance is just $860 per year, significantly less than the state average. USAA provides affordable insurance to current and former military members, including special coverage to replace uniforms, and that’s why we chose them for our list. Travelers has received excellent ratings for its financial strength and customer service. Allstate’s average premium in Arkansas is $2,455 per year, which makes it the most expensive company on our list, but you may pay considerably less with discounts.

No comments:

Post a Comment